Welcome to RGM Law Associates

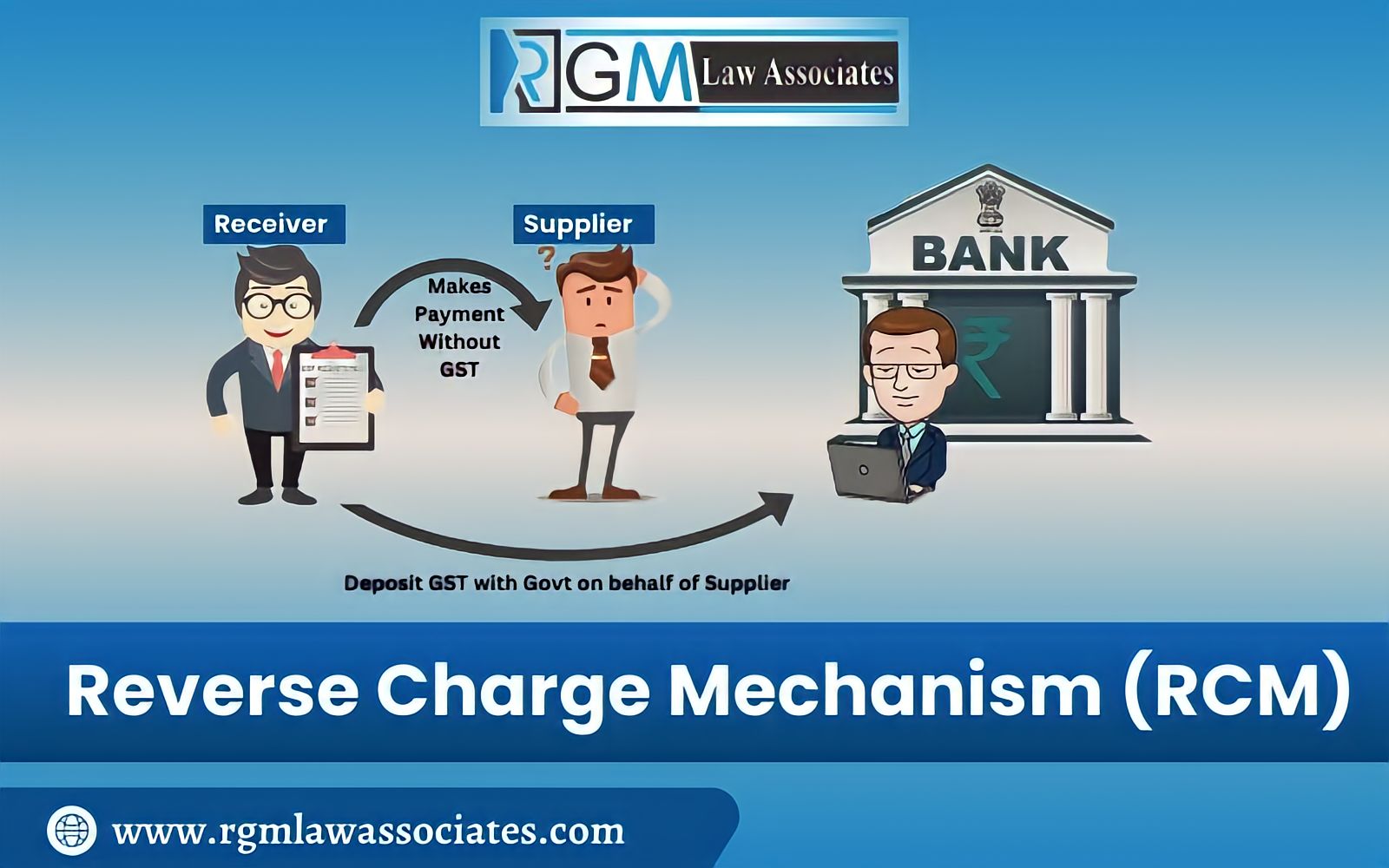

RGM Law Associates is a distinguished law firm founded in 2016. We are a team of lawyers who are experts in their individual fields of law. We are specialized in Goods and Service Tax, Central Excise Act and Service Tax, Trademarks, Cheque bouncing cases, and Recovery through Courts and the MSME Facilitation Council. With a commitment to excellence and a focus on client satisfaction, we provide a comprehensive range of legal services to meet the diverse needs of our clients across India, majorly in Haryana, Delhi, and Delhi NCR.

Our Areas of Expertise

Let Our Experience be Your Guide

WHO WE ARE

RGM Law Associates is a law firm founded in 2016 practicing mainly in areas of Indirect tax (GST, Excise, and Service Tax). Intellectual property Rights (IPR) and Recovery matters through civil court, Criminal court, Commercial court, Mediation, Arbitration, and MSME Facilitation Council.